There is the age-old adage that businesses should always stay ahead of the curve. But how can businesses stay ahead when changes happen on a daily basis?

Let us examine how COVID-19 has turned the lives of Indonesians upside down in just over a year to illustrate this point. Because of lockdowns, there are now as many people working from home as there are people working from offices. A Populix survey found that while workers initially enjoyed the freedom of working from home, increased interactions at home lead to more arguments and a deterioration in mental health. Simultaneously, the combination of too much time at home and financial pressure helped generate a cryptocurrency boom. According to Populix 7 out of 10 Indonesians know cryptocurrency and there are now more people investing in cryptocurrency as compared to stocks. For businesses, the pandemic triggered seismic changes in consumer behavior. For example, dine-in customers declined significantly and restaurants must instead rely on Grab and Gojek who control 80% of the food delivery market.

What this means is that traditional market research is no longer relevant. Every time a research is completed the world might have already moved on. Businesses must be able to understand changes to their environment in real-time and execute actionable insights immediately. Instead of thinking how to stay ahead of the curve, businesses must make sense of the world as the curve is curving.

This is especially true in South East Asia where the markets are growing and changing, at an exceptional pace. In Indonesia, where Populix is based, the country skipped some steps of industrial growth and leaped into becoming one of the most vibrant digital economies in the world. The speed is as staggering as the Jakarta street vendors serving nasi goreng in under three minutes.

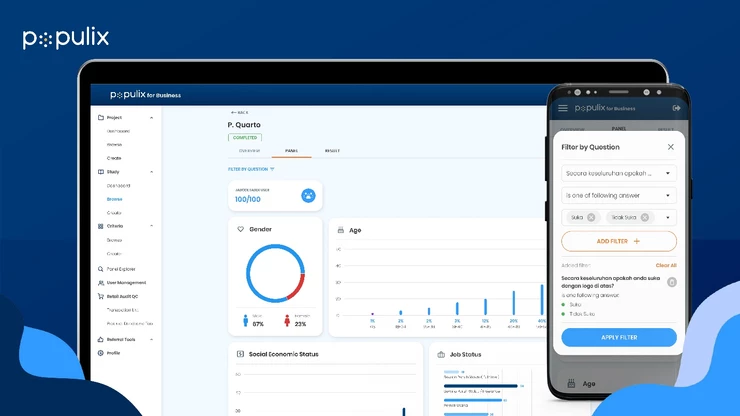

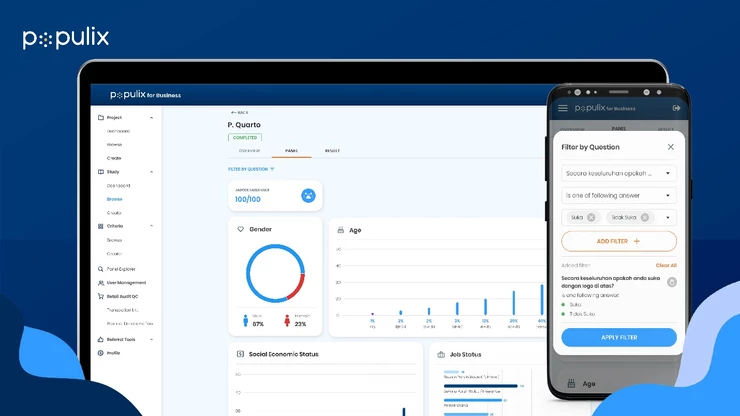

Populix is a consumer insights platform that help businesses connect with its database of over 250000 diverse, readily accessible, and highly qualified respondents across Indonesia. A credit scoring system for each respondent ensures authenticity and data accuracy. Focusing on the fact that Indonesian consumers are super sticky to their phones, Populix facilitates a diverse range of data collection methods via its mobile app. Businesses can therefore launch and monitor their insights in real-time. Since its inception, Populix has served over 100 clients in 56 industries across 10 countries. To achieve its mission of democratizing data for everyone and helping all businesses make good decisions, Populix serves a wide range of clients, from individual users to large multinationals. In fact, throughout the pandemic, there has been a surge in two types of new clients: old businesses struggling to adapt or new businesses that see opportunities emerging because of COVID-19. Know changes in the market, stay above the competition, and make the right moves. Scan the QR code on the right to check out our app or scan the QR code on the left to see how Populix can help your business.

IDN

IDN

ENG

ENG