Islamic banking, also known as sharia banking, has grown significantly in Indonesia over the past few years. As a predominantly Muslim country, Indonesia has a large population that adheres to Islamic principles, and many Indonesians prefer to use sharia-compliant financial products that are in line with their religious beliefs. In this paper, we will explore the future of sharia banking in Indonesia, including its potential for growth, the challenges it may face, and the opportunities it may offer.

Current State of Sharia Banking in Indonesia

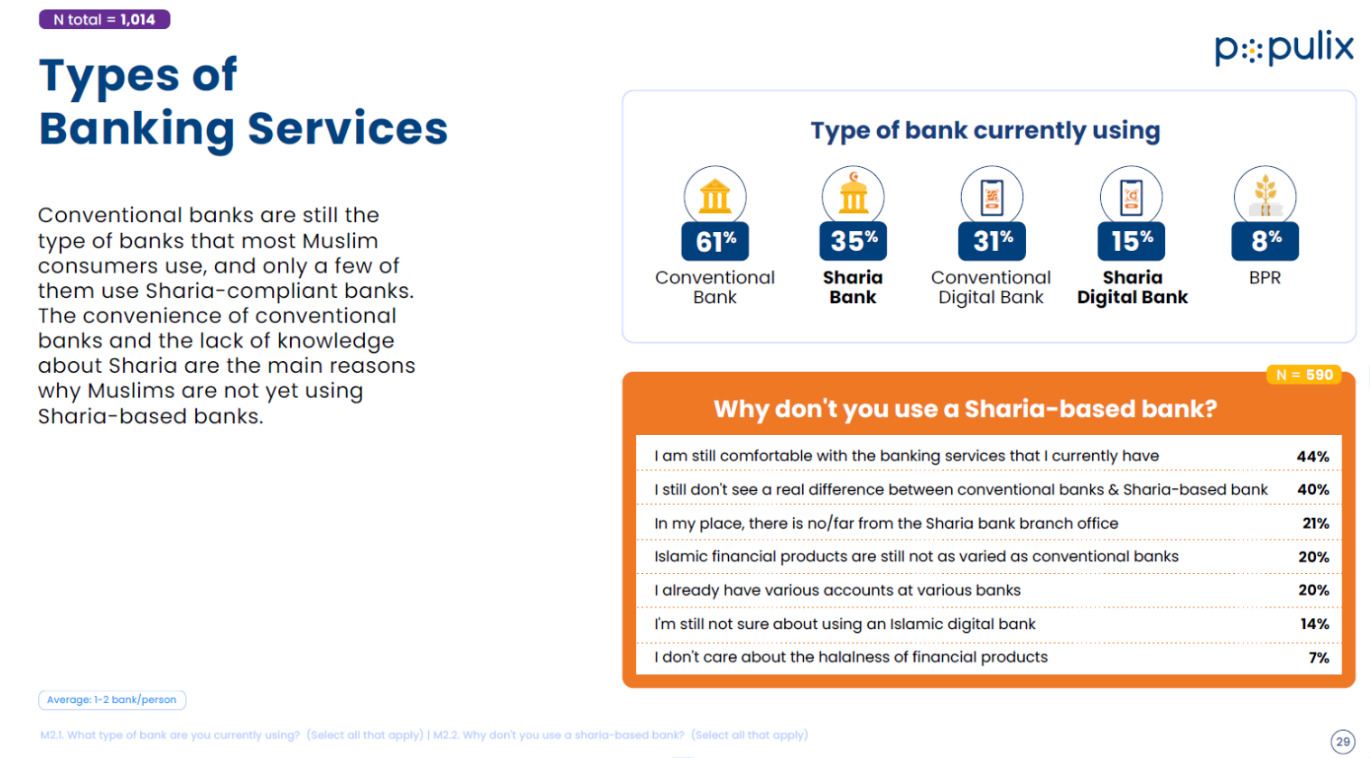

According to a recent survey conducted by Populix in March 2023 with a total 1,014 muslim panel, 50% of panel participants had an account in a sharia bank or a sharia digital bank. The remaining panel participants did not have a sharia-based bank account, with 44% indicating that they were still comfortable with their current bank services and 40% stating that they did not see a real difference between conventional banks and sharia-based banks.

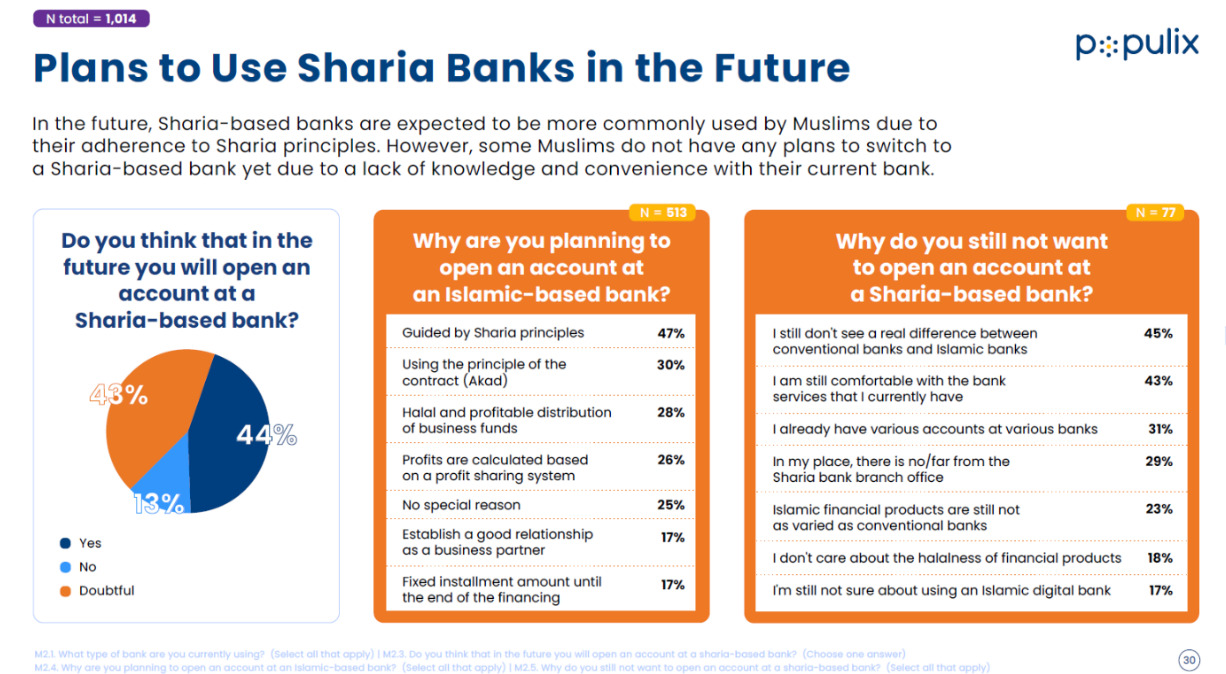

Interestingly, the survey revealed that halal system is not a priority for most Muslims when choosing their banking products. They prioritize facilities and customer experience instead. Nevertheless, among those who did not have a sharia-based bank account, the majority (47%) stated that they may have it in the future due to its sharia principles, and 30% indicated that they were interested in the Akad principle. These findings suggest that there is potential for growth in the sharia banking sector in Indonesia.

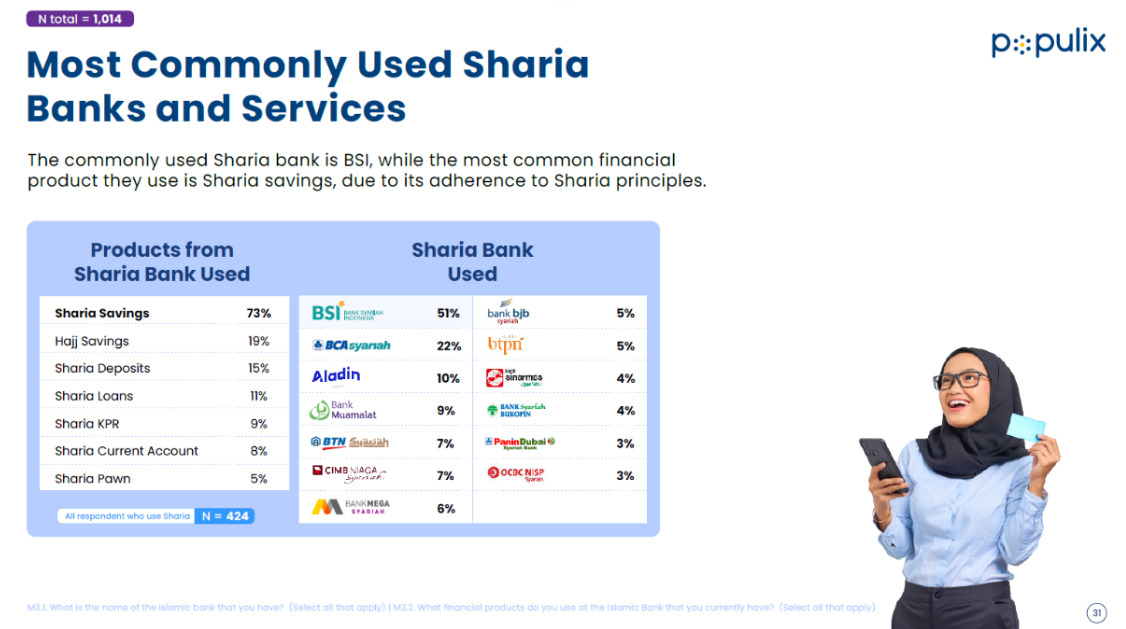

Among those who currently have a sharia-based bank account, Bank Syariah Indonesia (BSI) is the most commonly used bank, with 51% of respondents using it. BCA Syariah and Bank Aladin followed BSI with 22% and 10% usage, respectively. The majority of sharia banking customers use sharia savings products due to their adherence to sharia principles and the Akad principle.

Related article: Begini Tren Investasi di Indonesia Menurut Data Survei Populix

Potential for Growth in Sharia Banking

The potential for growth in sharia banking in Indonesia is significant, given the country’s large Muslim population and the growing awareness of the benefits of sharia-compliant financial products. However, the growth of sharia banking in Indonesia is still relatively small compared to conventional banking. Sharia banks currently account for only 7.4% of the total banking assets in Indonesia (source: multiple media coverage).

One factor that may drive the growth of sharia banking in Indonesia is the increasing demand for sharia-compliant financial products. As more Indonesians prioritize sharia principles in their financial dealings, they are likely to turn to sharia banks for their banking needs. Sharia banks can leverage this trend by offering innovative sharia-compliant products and services that cater to the unique needs of their customers.

Another factor that may drive the growth of sharia banking in Indonesia is the growing awareness of the benefits of sharia-compliant financial products. As more people become aware of the principles of sharia banking, they are likely to be attracted to its ethical and moral standards. Sharia banking provides an opportunity for individuals to invest in companies that are ethical and socially responsible, which can be a significant draw for customers looking for a socially responsible investment.

Related article: Mengenal Investasi Syariah dan 3 Jenis Terbaik untuk Pemula

Challenges Facing Sharia Banking in Indonesia

One of the main challenges facing sharia banking in Indonesia is competition from conventional banks. While sharia banks have seen significant growth in recent years, they still face stiff competition from conventional banks. Conventional banks often offer a wider range of products and services, and their services are generally more convenient and accessible.

To remain competitive, sharia banks will need to continue to offer innovative products and services that cater to the unique needs of their customers. They will need to invest in technology and digital banking to offer a seamless and convenient banking experience, particularly as more consumers turn to digital channels for their financial needs. Sharia banks may also need to explore new partnerships and collaborations to expand their reach and offer a wider range of products and services.

In addition, sharia banks will need to continue to educate consumers about the benefits of sharia banking and its principles, in order to differentiate themselves from conventional banks and build trust with their customers. This may involve greater investment in marketing and public relations, as well as targeted educational campaigns and initiatives.

Ultimately, the success of sharia banking in Indonesia will depend on the ability of sharia banks to innovate and adapt to the changing needs and preferences of their customers. By investing in technology, customer experience, and education, sharia banks can position themselves for long-term growth and success in Indonesia’s increasingly competitive financial sector.

Summary

Overall, it is clear that the future of sharia banking in Indonesia is bright, with continued growth expected as more consumers become aware of the benefits of sharia banking and the principles it is based on. While halal banking may not be the top priority for many Muslim consumers, it is clear that a significant number of them are choosing sharia banks and digital banks for their financial needs.

However, it is also clear that there is still work to be done to educate consumers about the benefits of sharia banking and to differentiate it from conventional banking. This may include more targeted marketing campaigns, as well as greater investment in customer experience and facilities to ensure that sharia banks can compete with their conventional counterparts.

Looking ahead, it is likely that sharia banking will continue to play an increasingly important role in Indonesia’s financial sector. As more consumers become aware of the benefits of sharia banking and the principles it is based on, we can expect to see continued growth in the number of sharia banks and digital banks, as well as increased investment in customer experience and facilities.

In conclusion, while there is still work to be done to promote the benefits of sharia banking and to differentiate it from conventional banking, the future of sharia banking in Indonesia is bright. As more consumers become aware of the benefits of sharia banking and the principles it is based on, we can expect to see continued growth in this sector, with sharia banks and digital banks playing an increasingly important role in Indonesia’s financial sector.

This white paper was written by Indah Tanip, Head of Research at Populix, a leading market research firm in Indonesia. Populix is dedicated to providing insights and analysis on the latest trends and developments in Indonesia’s financial sector, and is committed to helping businesses and organizations make informed decisions based on data-driven insights. For more information about Populix and its services, please visit our website at www.populix.co.id.

Also read: The Power of Storytelling: Why Brands That Tell Great Stories Win Big

IDN

IDN

ENG

ENG